The debates over vouchers and over whether local school boards must send students to private schools if parents would prefer that are not really about parental choice or private school choice. They are about money - whether New Hampshire should spend millions of dollars to send a few children to private schools.

But the New Hampshire contribution to public education is already inadequate.

Every New Hampshire Legislature reopens the school funding debate but several factors have combined to intensify the battle between state policy makers and local tax payers.

Dover won its lawsuit establishing that there could be no cap on the increase in state education funding when communities like Dover experience high growth in their student enrollments. At the same time, a number of property poor, lower growth communities are lobbying against the loss of what’s called “stabilization funds” - an extra payment to the poorest communities. They and others are considering a renewed court challenge on education funding (more here from Attorney John Tobin, the former executive director of New Hampshire Legal Assistance).

At the same time, the Governor and his State Board of Education and Department of Education are seeking to give each parent private school vouchers, the right to allocate these same funds to private and home schools. They lost a hard-fought battle in the last legislative session, but have promised to be back until they win.

But at root, the Governor is contesting with New Hampshire’s property tax payers over what is already the smallest state contribution to public education in the country - by far.

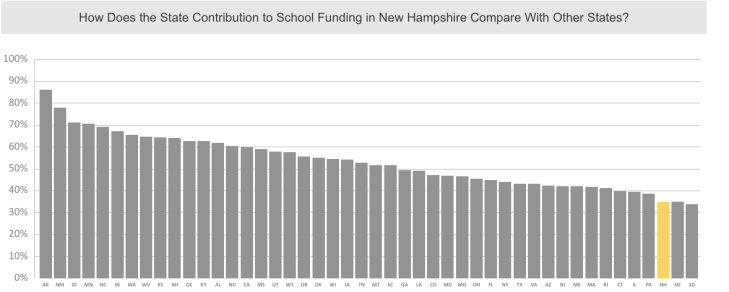

The chart called “How Does the State Contribution to School Funding in New Hampshire Compare With Other States?” on this page shows the proportion of non-federal K-12 education costs that each state contributes. You’ll see NH highlighted in yellow, third from the bottom, at 35% (in 2015; it’s 33% now):

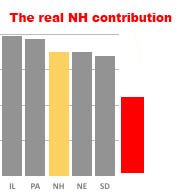

But even that is misleading because the state contribution includes the Statewide Education Property Tax (SWEPT), a local property tax statutorily re-characterized as state funds. For other states, the chart shows contributions the actual state contribution. When you look at the comparable New Hampshire contribution - just from the state’s Education Trust Fund, not including the SWEPT - the state contribution is only 20% of the non-federal cost. The next lowest state is North Dakota at 34%. New Hampshire’s real contribution is the red bar, not the yellow bar. The difference between the two is the SWEPT.

ANHPE will track the debate over the school funding, local property taxes and a potential constitutional amendment to further reduce education funding in the state that already provides the lowest education funding levels in the country.

[…] Advancing New Hampshire Public Education blog featured a post yesterday with graphics that underscore how poorly funded New Hampshire public schools are. This is […]

Thank you-this information should be useful.