This post was written by Doug Hall and edited by Bill Duncan. If you would like to hold a forum to discuss school funding in your community, click here.

New Hampshire school districts first brought the Claremont lawsuit, as it is called, against the State of New Hampshire in 1991. The New Hampshire Supreme Court first ruled on it in the Claremont I decision of 1993 and, then, it ruled again in the Claremont II decision of 1997.

The plaintiffs had two goals:

- Reduce the disparity in spending per pupil among the school districts; and,

- Reduce the disparity in property tax rates for schools paid by local property tax payers.

The court concluded that the provision of an “adequate education” was a state responsibility and under the Constitution must therefore be funded by taxes that are uniform in their rates.

The first reform measure enacted by the New Hampshire legislature to comply with the Supreme Court decisions went into effect in 1999. It included a uniform statewide property tax to be distributed to the school districts and increases in other taxes.

So what have been the results?

Goal 1: Spending per pupil

One goal of the Claremont lawsuit was to provide a more equal investment in education for students who lived in different school districts. In their case, the plaintiffs used spending per pupil as one proxy measure of the differences in the quality of education between districts and the NH Supreme Court cited such differences in its Claremont I ruling.

But Figure 1, below, shows that the disparity in funding per student never really changed. In this chart and those that follow, each town in one dot. The towns with the lowest 1998/99 (before reform) spending per pupil are on the left and the highest on the right. The purple line created by the 222 dots representing each town traces the per pupil spending before reform. The yellow line is immediately after reform.

It is clear that the disparity in spending per student never changed.

Figure 1

And if you look at the 2016/17 school year in Figure 2, the most recent school year for which data are available, you see the same pattern. The 1998/1999 school year (before reform) is still the purple line and 2016/17 is the yellow. The only real difference is that the highest spending schools are now spending even more than before in comparison with the median town.

Figure 2

Another way to look at spending progress is to compare a sample of towns before and after reform. Table 1 pulls out representative towns from the charts above and shows the actual spending per pupil by the median town (an equal number of towns spent more and spent less per pupil), an a representative sampling at the low end and at the high end.

(Just to be clear, the actual town names change each year. The 6th lowest in 1998/99 will probably not be the 6th lowest in 1999/00 and the 6th lowest in 2016/17 will be different yet again. The importance of this table is that it shows the useful comparisons regardless of the changes regardless of the shifting among towns.)

Table 1

In the top rows you see the actual numbers. Then you see the same towns again, with their spending displayed as a percent of the median – how much lower or higher that towns spending is compared to the median town.

And finally, the last two rows compare the representative highest and lowest towns each year. This shows very little change as a result of the Claremont decisions.

For instance, in 2016/17 the town with the 6th highest spending per elementary pupil (it happened to be Stratford at that point) spent 2.17 times that of the town with the 6th lowest spending per elementary pupil (Greenville, in 2016/17). So for an elementary class of 20 students, Stratford is spending $264,000 more than Greenville for the same size class. And this will continue every year.

Data for spending per pupil at the high school level show a similar pattern.

All in all, the State’s response to the court’s rulings never made any difference in the large disparities in spending per pupil.

Goal 2: Property tax rates for schools

A second goal of the Claremont lawsuit was to reduce the differences among the towns in their property tax rates. The NH Supreme Court explicitly cited the large differences in property taxation in its Claremont II ruling.

Figure 3, below, compares each town’s equalized tax rate for schools between tax year 1998 (before reform) and tax year 1999 (after reform). The “equalized” tax rate is an important figure. The NH Department of Revenue Administration “equalizes” locally assessed values every year to make the process as fair as possible. They do this by comparing local valuations with recent actual property sales in each town.

Again, the rough looking lines in Figure 3 are actually made up of dots, each one representing a town. The number that’s graphed for each town is not the tax rate itself but the ratio of that town’s equalized property tax rate to the tax rate of the median town. (So if you sorted 221 New Hampshire towns by their equalized property tax rates for schools, there would be 110 towns with higher tax rates than the median town and 110 with lower rates.)

If we had taxpayer equity in New Hampshire, the line in Figure 3 would be pretty close to horizontal. The purple line represents the inequity the New Hampshire Supreme Court objected to in its Claremont II ruling. The green line is the impact of the ruling.

It is clear that the tax disparity was initially reduced somewhat, but it was far from eliminated.

Figure 3

However, in the years since 1999, the legislature has changed school finance laws many times. Figure 4 adds a third line to the chart. It shows the equalized tax rates in 2017, the most recent year for which equalized tax rates are available.

Figure 4 shows that we have now returned to the same pattern that existed before reform in 1998. In fact, some disparities have increased somewhat.

Figure 4

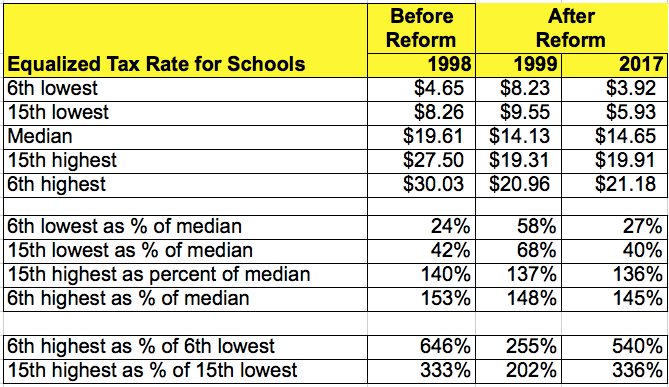

Table 2, below, again compares selected high and low tax towns with the median town. The table reveals that the reduction in the disparity among tax rates that occurred between 1998 and 1999 has now been reversed. The wide variation in tax rates that existed in 2017 was nearly identical to that of 1998.

Table 2

What’s to be done?

In its 1997 Claremont II decision, the Court stated

“…we hold that the present system of financing elementary and secondary public education in New Hampshire is unconstitutional. To hold otherwise would be to effectively conclude that it is reasonable, in discharging a State obligation, to tax property owners in one town or city as much as four times the amount taxed to others similarly situated in other towns or cities. This is precisely the kind of taxation and fiscal mischief from which the framers of our State Constitution took strong steps to protect our citizens.”

The Supreme Court ruled that the conditions it was presented with in 1997 were unconstitutional. What would it say today when the disparities in spending and taxes are identical to those of that time?

In the same ruling, the Court stated,

“The right to an adequate education mandated by the constitution is not based on the exclusive needs of a particular individual, but rather is a right held by the public to enforce the State’s duty. Any citizen has standing to enforce this right.”

The Court has explicitly given us the responsibility and the authority to ensure that all of our children have an opportunity for an adequate education. Are we up to the challenge?